How Scaler's AI Turns Sustainability Data Into Portfolio Value

The Shift: From Reporting to Results

The conversation in commercial real estate has changed. Five years ago, sustainability was about ticking boxes and data collection. Today, it's about performance and increasing the impact. Investors are asking different questions: Which buildings are costing us the most to operate? Where can we reduce energy consumption fastest? What's the ROI on that LED retrofit versus a building management system upgrade?

The problem? Most teams are still buried in data collection. They have the information somewhere, but finding it, analyzing it, and turning it into decisions takes too long.

We built Lumi to fix that.

Introducing Lumi: AI That Drives Action

Lumi is Scaler's AI assistant, built on Anthropic's Claude and deployed entirely within our AWS infrastructure. No data leaves your environment. No training on your information. Full enterprise security.

But security is table stakes. Here's what actually matters: Lumi helps you act faster.

1. Meter Intelligence (New! Just launched)

Lumi now has direct access to meter and consumption data across your portfolio. Ask questions, get answers, take action.

What this unlocks:

"Which assets have the highest energy intensity per square meter?"

"Show me buildings where consumption increased more than 10% year-over-year"

"What's driving the cost spike at this property?"

No more exporting data to Excel. No more waiting for someone to run a report. The insight is immediate, and so is the path to action.

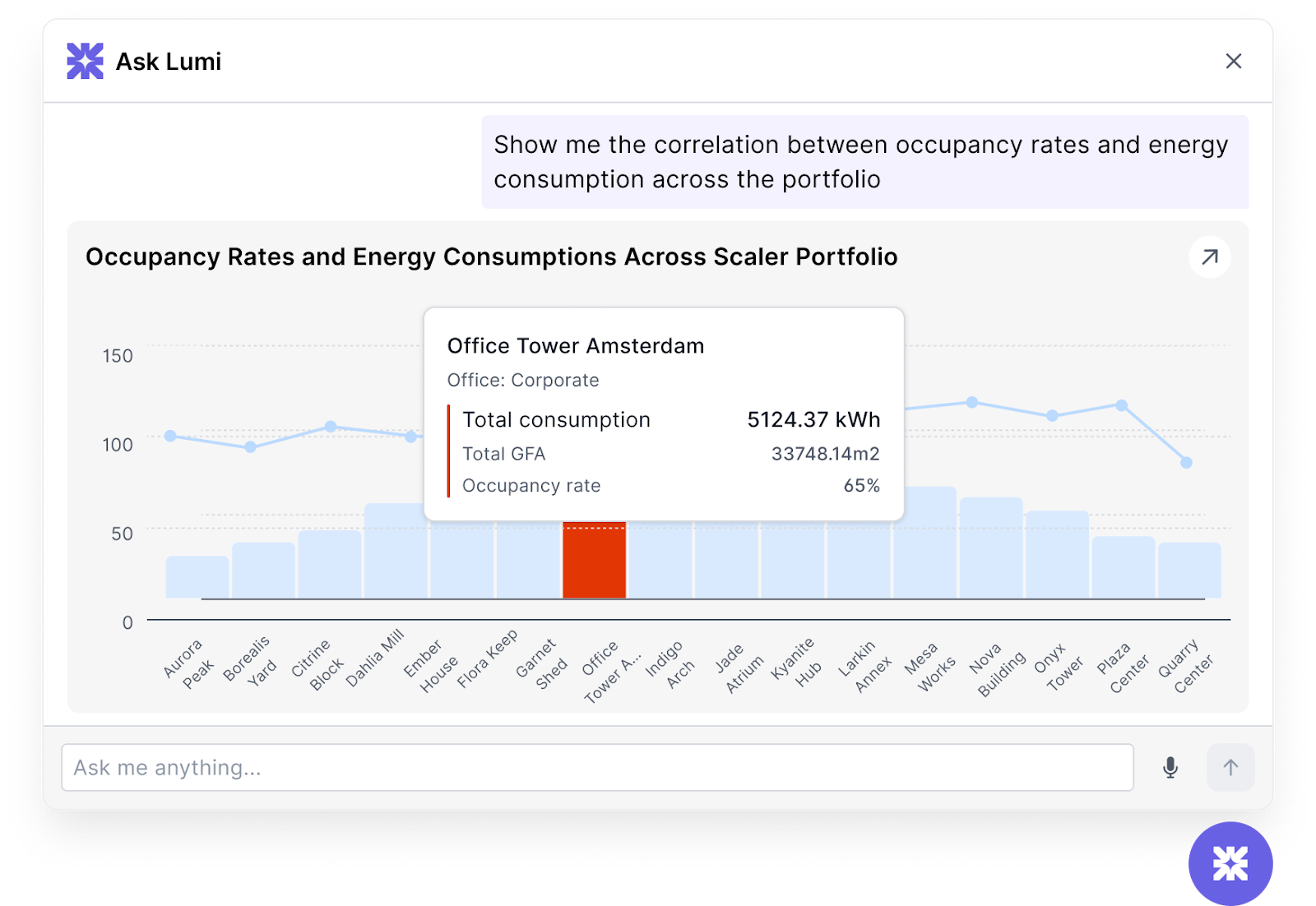

2. Portfolio Data Analyst

Ask any question about your real estate portfolio and get an immediate answer. Lumi understands the relationships between assets, funds, tenants, and operational metrics.

Examples that drive decisions:

"Rank my assets by operational cost per square meter"

"Which properties have the best and worst water efficiency?"

"Show me the correlation between occupancy rates and energy consumption across the portfolio"

This is the analysis that used to take hours. Now it takes seconds.

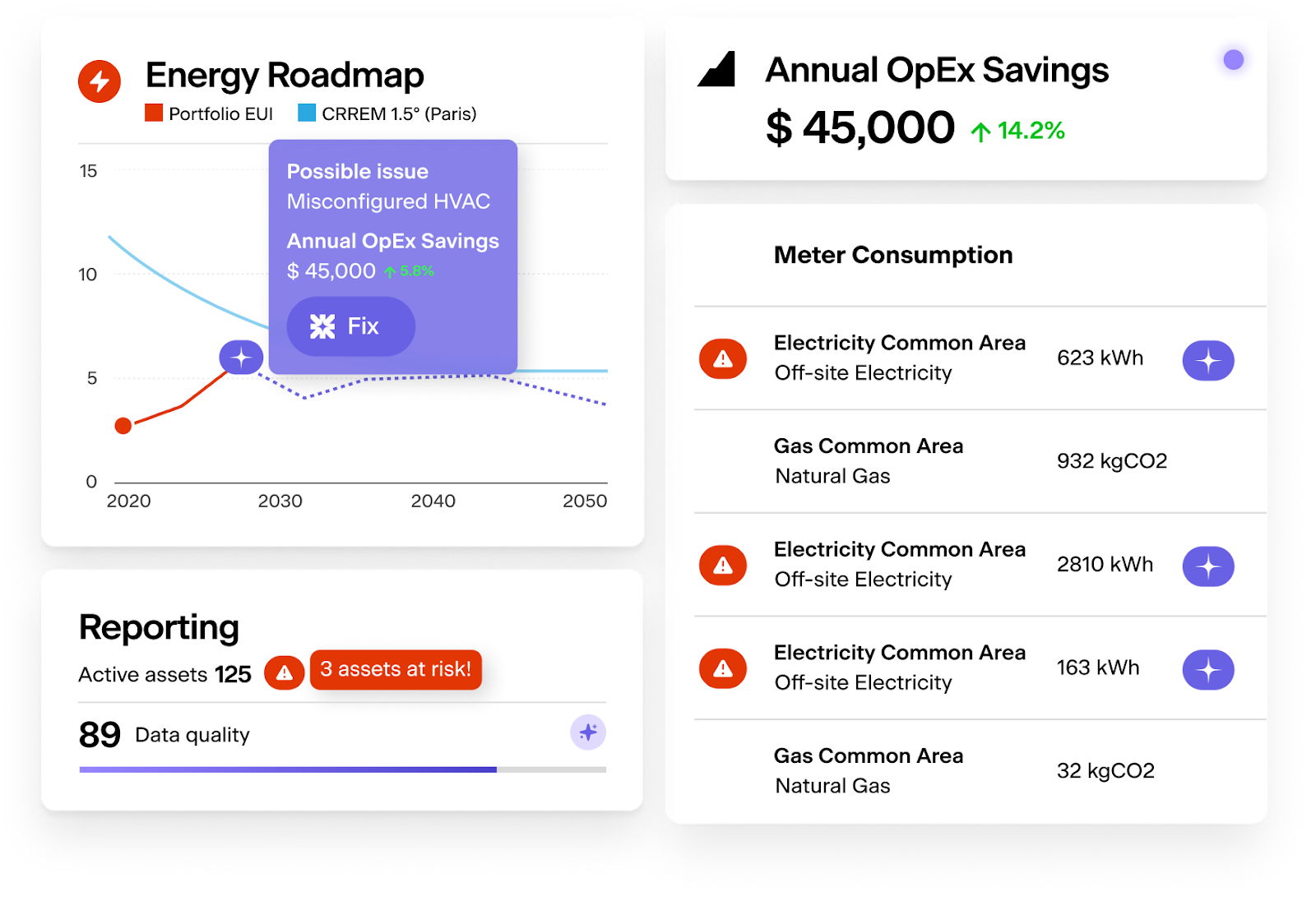

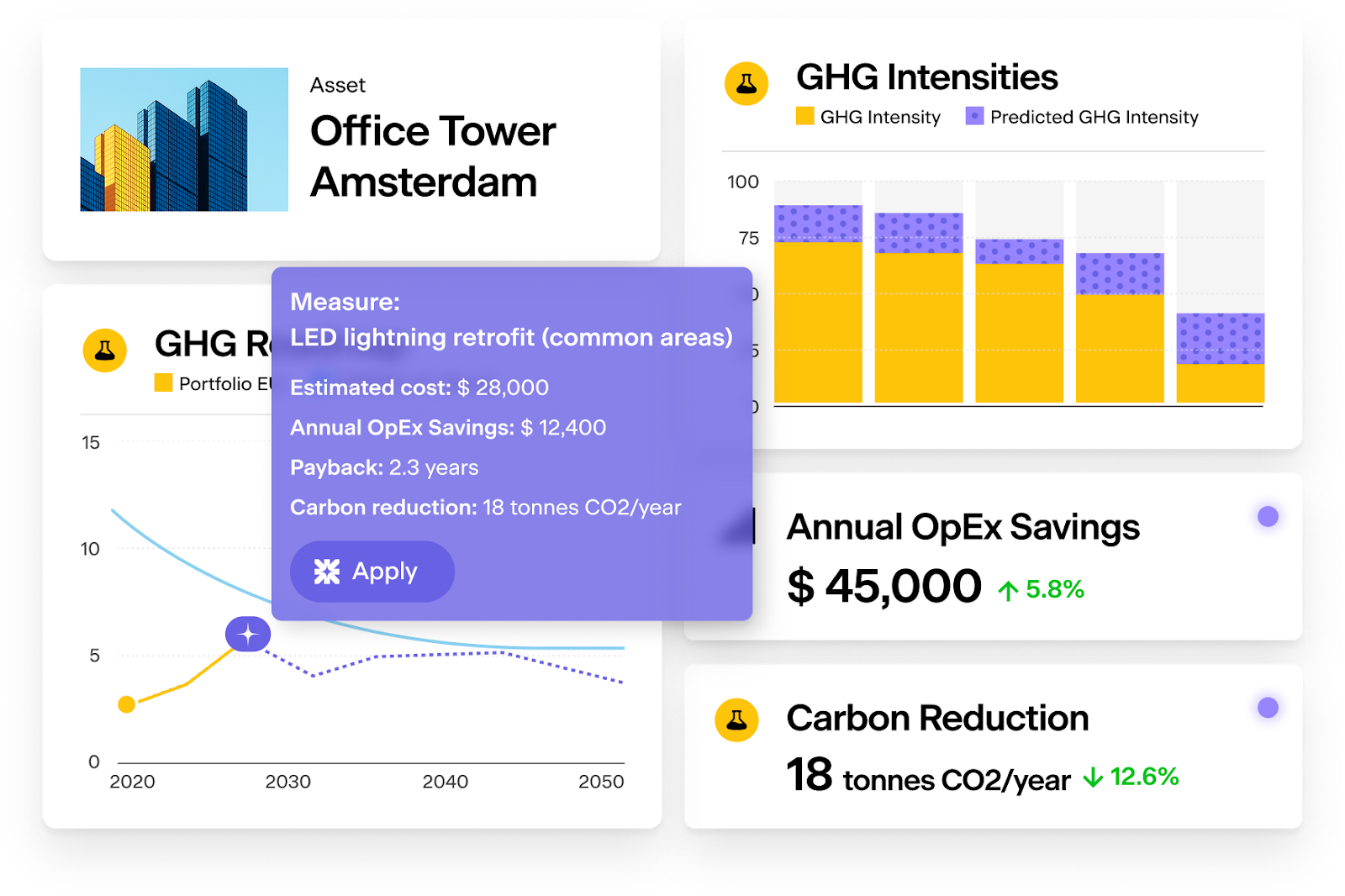

3. AI-Powered Efficiency Measures

Here's where Lumi moves from insight to action. Based on your portfolio's actual consumption data, building characteristics, and location, Lumi recommends specific measures to reduce costs and carbon.

What makes this different:

Recommendations are ranked by ROI and payback period

Each measure includes implementation guidance specific to the asset

Progress tracking shows actual versus projected savings

No generic checklists. Concrete actions tied to your buildings, your data, your investment criteria.

4. Always-On Advisor

Questions come up constantly. What's the best approach for tenant sub-metering? How should we handle a building with multiple utility accounts? What benchmarks should we use for this property type?

Lumi provides contextual guidance based on your specific portfolio configuration, drawing from our knowledge base and real-world implementation experience.

This isn't generic AI advice. Lumi knows your data model, your operational setup, and your investment strategy.

5. Proactive Data Quality

Bad data leads to bad decisions. Before you rely on consumption trends or efficiency metrics, you need confidence in the underlying numbers.

Lumi scans your portfolio for anomalies: consumption spikes that don't match occupancy, missing meter readings, inconsistent configurations. Issues surface before they affect your analysis or your auditors.

Why this matters for action: You can't optimize what you can't measure accurately. Clean data is the foundation for every efficiency initiative.

6. Automated Coverage Strategy

Most portfolios have gaps. Some assets have complete meter coverage; others are missing key data points. Lumi analyzes what's missing and generates a prioritized plan to close the gaps.

The output tells you: where to focus first, what data to request from property managers, and how improved coverage will enhance your ability to identify savings opportunities.

Security: Built for Institutional Requirements

Lumi runs entirely on AWS Bedrock within Scaler's tenant-isolated infrastructure.

No Data Exposure: Your portfolio data never leaves your Scaler environment. No external API calls. Complete isolation between clients.

No Model Training: Your data is never used to train any models. Full compliance with enterprise data governance.

Enterprise Controls: Prompt logging, usage limits, role-based access. For clients with strict AI policies, Lumi can be disabled while maintaining full platform functionality.

The Bottom Line: Time Back, Value Created

Every hour your team spends hunting for data is an hour not spent on measures that improve asset performance.

Early adopters are seeing the shift:

Faster Analysis: Questions that took 30+ minutes now take seconds. Portfolio reviews that required a week of preparation now happen on demand.

Better Decisions: With instant access to consumption patterns and benchmarks, teams identify opportunities they previously missed.

Higher ROI on Efficiency Investments: Measures are prioritized by actual payback, not guesswork. Capital goes where it creates the most value.

Reduced Operational Costs: Anomaly detection catches issues (misconfigured systems, billing errors, equipment failures) before they compound.

What's Next

This is the beginning. We're expanding Lumi's capabilities:

Direct data editing through conversational commands

Automated scenario modeling for efficiency investments

Integration with utility and building management systems

Multi-language support for global portfolios

The goal isn't better reports. It's better buildings.