SFDR Reporting Made Simple for Real Estate

- 1

Easy Data Input

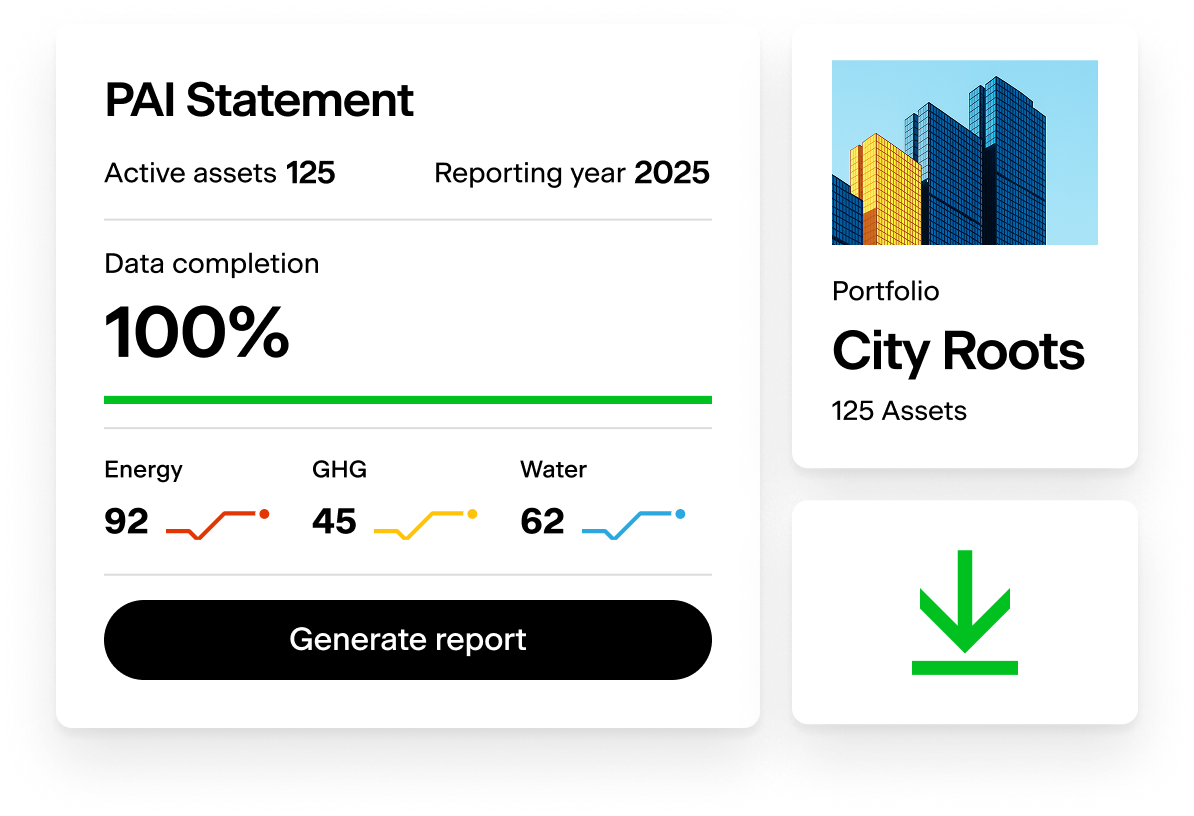

Input data directly or via Excel/CSV import and compute mandatory and voluntary PAIs at both the financial product and entity level. - 2

Fast Validation & Generation

Review data for accuracy and generate PAIs with the click of a button for website and pre-contractual disclosures. - 3

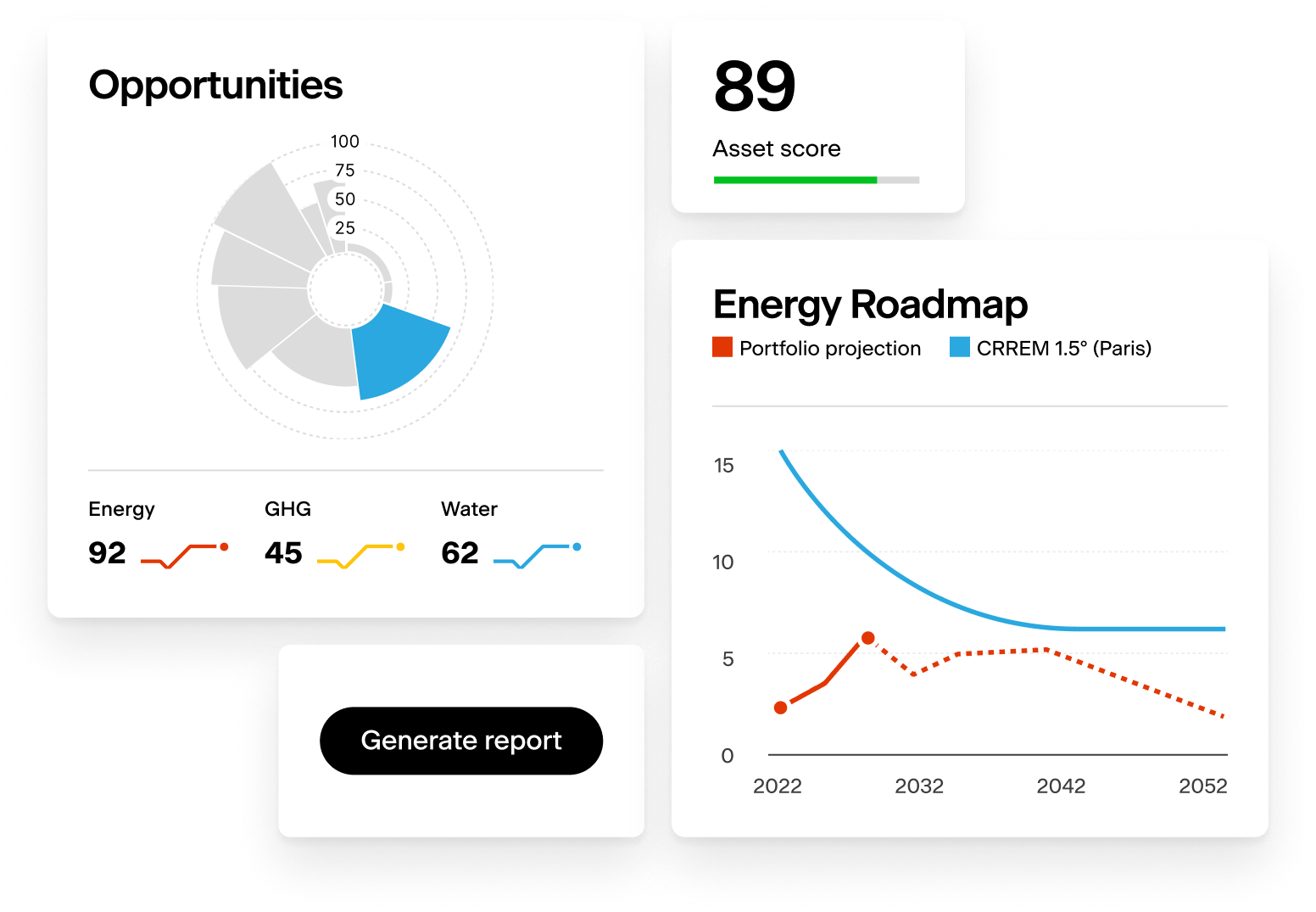

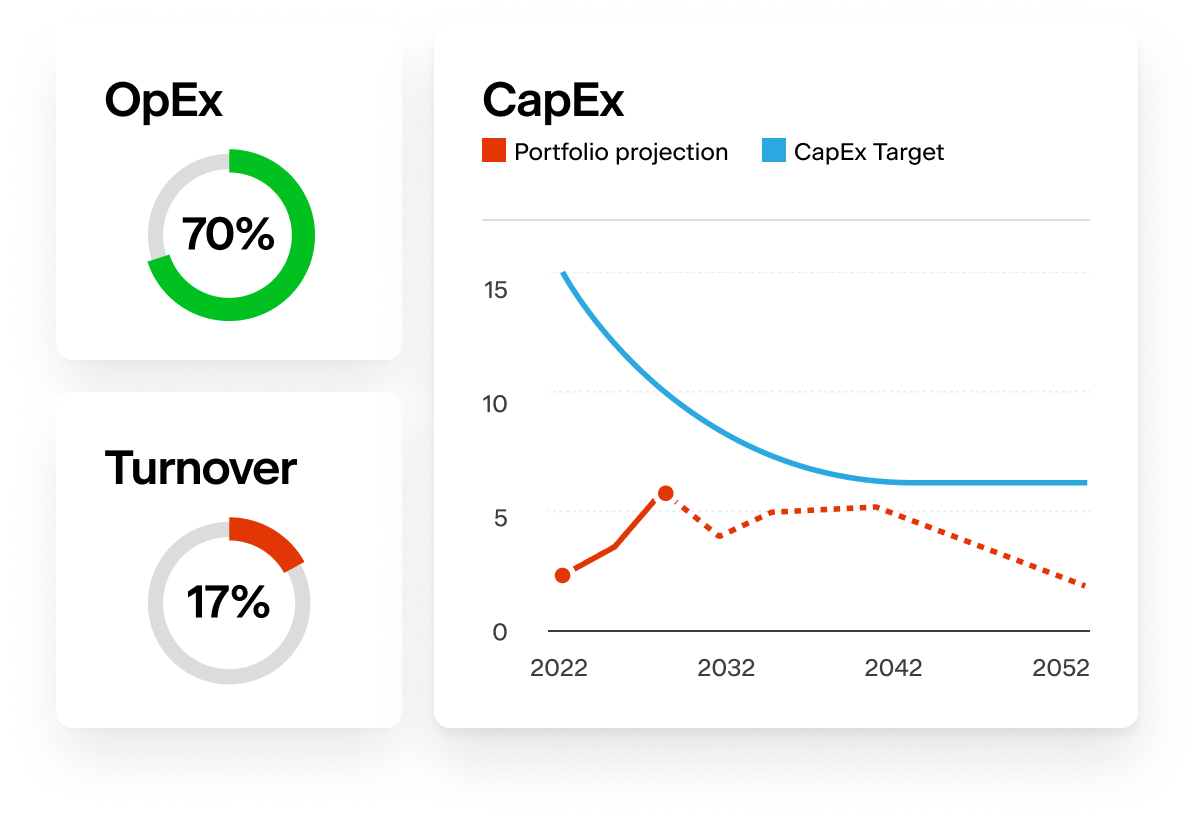

Clear Performance Tracking

Measure the performance of investments against relevant real estate PAI indicators. - 4

Smart Compliance Monitoring

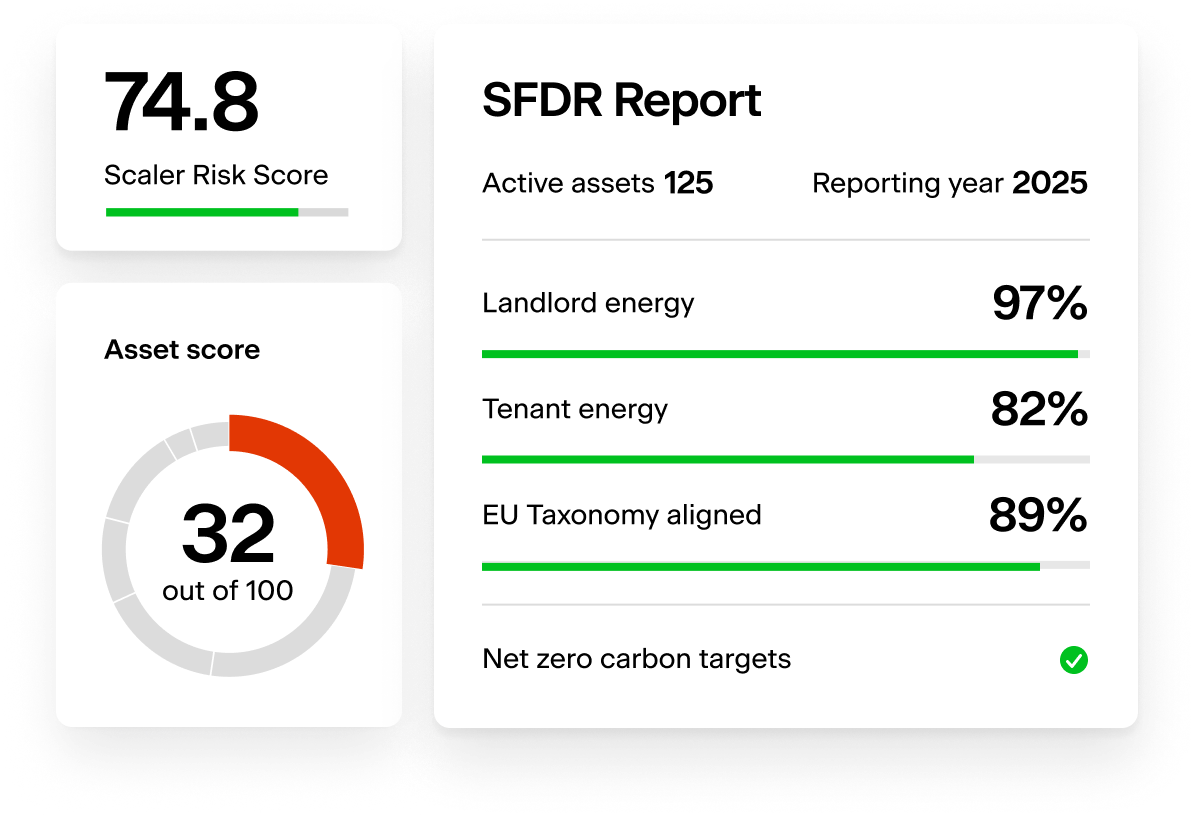

Monitor SFDR compliance with our dynamic dashboard to gain actionable insights. - 5

Seamless EU Taxonomy Calculation

Calculate EU Taxonomy alignment within the same streamlined workflow.

Getting ESG Data Right for SFDR

The Sustainable Finance Disclosure Regulation was introduced as part of the EU Sustainable Finance package to improve transparency and prevent greenwashing in the market for sustainable investment products.

Qualitative and quantitative metric requirements for the Principle Adverse Impact Statement (PAIs) expose industry-specific challenges around ESG data and the need for robust data management systems and reporting mechanisms.

Check the latest implementation timeline for SFDR:

View the official SFDR timeline on the ESMA website (PDF)

We do the heavy lifting and get you ready to comply:

Collect ESG and financial data and set KPIs for environmental and social characteristics promoted by your funds

Monitor performance and calculate PAI indicator metrics

Produce your PAIS for Article 8 and 9 funds and report your EU Taxonomy alignment

Principal Adverse Impact Statement

EU Taxonomy Alignment

Who Needs to Report?

SFDR applies to financial market participants and financial advisors in the EU, including those with EU shareholders and those promoting themselves within the EU.