Improving GRESB Scores: Insights from Asset-Level Performance

As the global emphasis on sustainable investing intensifies, the GRESB (Global Real Estate Sustainability Benchmark) Score has become a crucial metric for assessing the ESG performance of real estate portfolios. At Scaler, we understand that to improve your GRESB Score, it's essential to focus on granular, asset-level performance. Our platform facilitates this focus and enables you to enhance your overall portfolio performance, showcasing your commitment to sustainability to shareholders.

In this article, we share insights on how to improve your GRESB Score by examining and optimizing asset-level performance.

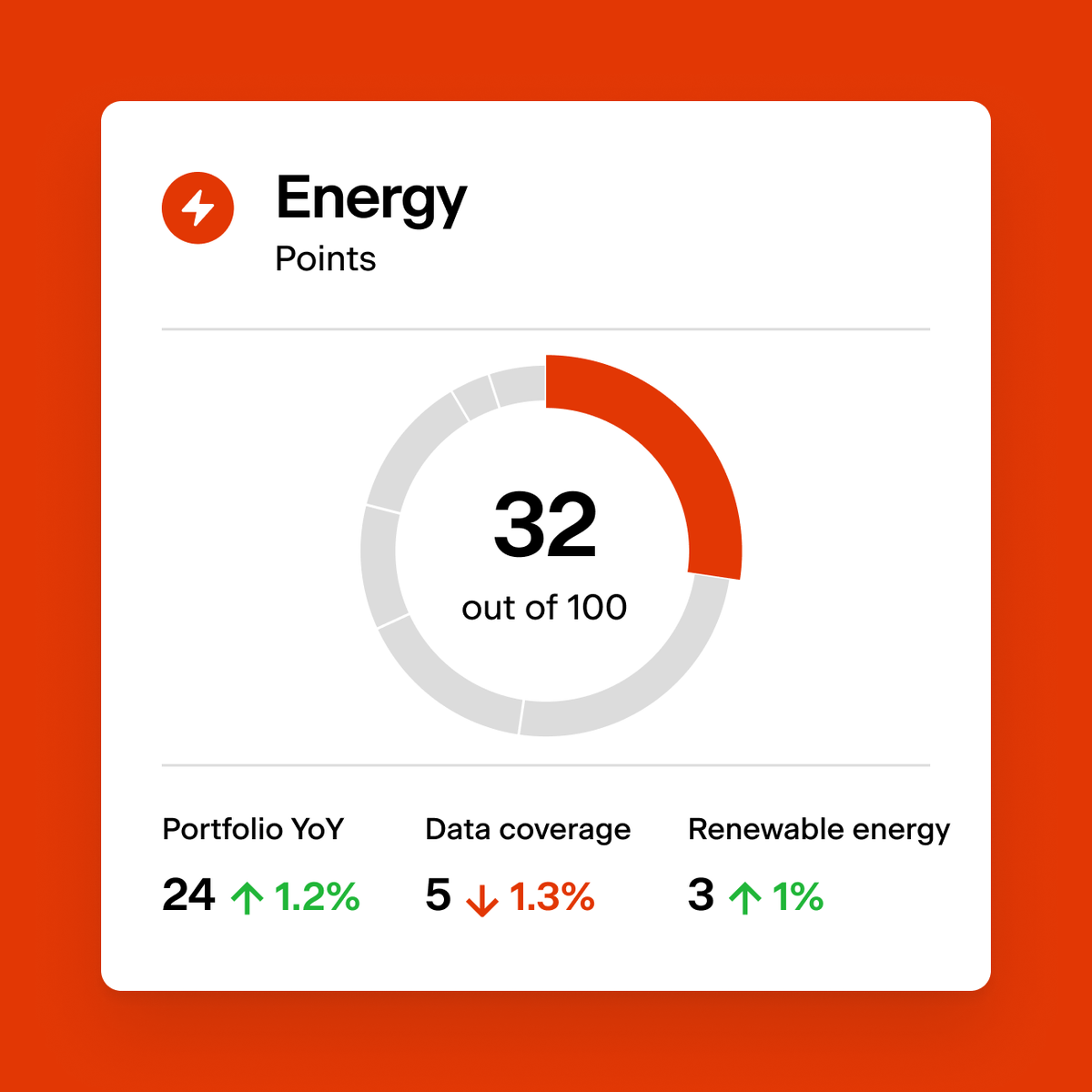

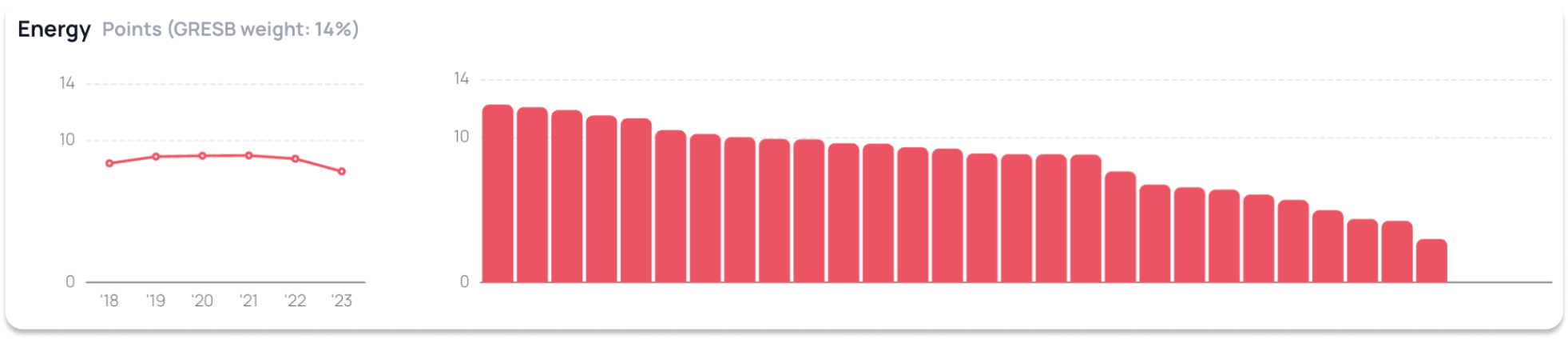

Understanding GRESB's Energy Data Scoring

GRESB scores energy data at the asset level based on three main criteria: Data Coverage, Like-for-Like (LFL) Change, and Renewable Energy Percentages (both onsite and offsite). The GHG, water, and waste data are scored similarly, but instead of focusing on renewable energy, the emphasis is on water reuse and the amount of waste diverted from landfills.

Each criterion requires precise data collection and rigorous analysis:

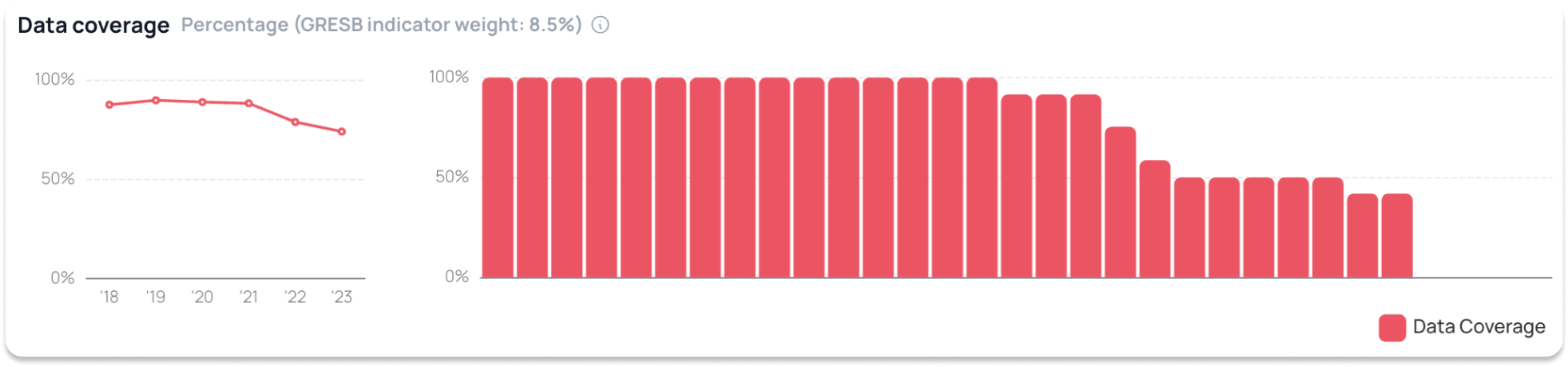

Data Coverage (8.5 points)

GRESB evaluates data coverage via two dimensions – Area and Time.

Area: This refers to the percentage of the total portfolio area for which performance data is available.

Time: This measures the percentage of the ownership period for which performance data is available.

Ensuring comprehensive data coverage in both these dimensions is critical. For example, if you have a property portfolio spanning 1,000,000 square feet and performance data is available for 950,000 square feet, your data coverage (area) is 95%. And you should strive to have consumption data for the entire reporting period where the asset was under your ownership. For example, if the asset was owned for the whole reporting period, you should have coverage for the full 365 days.

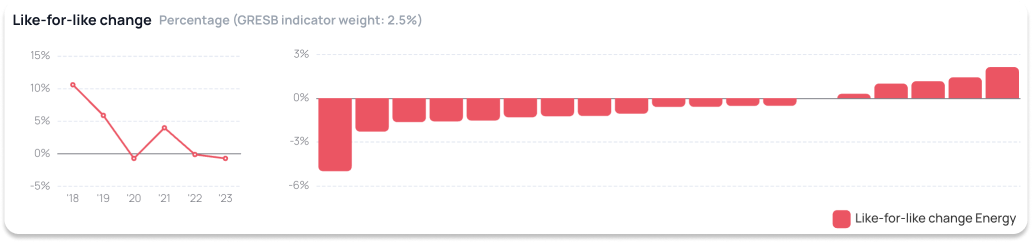

Like-for-Like Change (2.5 points)

Like-for-Like (LFL) Change: This metric assesses the change in performance data for comparable assets over two consecutive reporting periods. Assets included in LFL calculations must meet stringent criteria:

Classification as a Standing Investment (for the entirety of the two consecutive reporting periods).

Full reporting period data availability, (over 355 days)

Consistent data coverage (within a 1% error threshold), AND which is not negative

Improving LFL change requires consistent and comparable data across years. Identifying and addressing performance issues in assets that consistently underperform can lead to significant improvements in this metric.

You gain a half point simply for having any data that can be compared Like-for-Like. And this is even relevant if you weren’t able to complete your data collection in the previous reporting season. For example, you implemented new data collection processes and only obtained 50% energy consumption data coverage for the 2023 assessment (over 2022 data), but now have 100% data collection for both 2022 and 2023. Update your energy consumption and coverage for 2022 and receive credit in this year’s assessment for Like-for-Like.

The remaining two points are based on having negative Like-for-Like change, i.e. lower energy consumption year over year.

Renewable Energy (3 points)

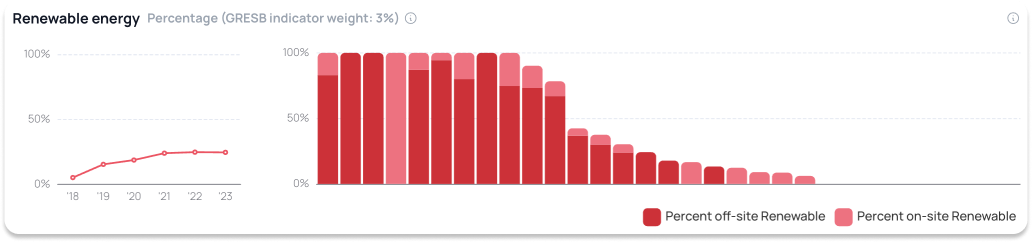

A critical aspect of improving your GRESB score is optimizing the use of renewable energy within your portfolio. GRESB scores this section by evaluating both onsite and offsite renewable energy. The scoring methodology for renewable energy is divided into two main parts:

Initial Renewable Energy Generation:

Onsite Renewable Energy: If any onsite renewable energy was generated in the current year, this can earn up to 1 point, or 1/3 of the maximum score.

Offsite Renewable Energy: If no onsite renewable energy was generated, but some offsite renewable energy was consumed in the current year, this earns 1/6 of the maximum score.

Renewable Energy Percentage and Improvement:

The remaining 2 points, or 2/3 of the maximum score, are based on the percentage of renewable energy used in the current year and the increase compared to the previous year. The improvement score is calculated based on the increase in the percentage of renewable energy compared to the previous year. This score is benchmarked against the improvements of other assets, ensuring a fair comparison. So do take note that the points received are dependent on keeping pace with your peers.

By focusing on increasing both onsite and offsite renewable energy usage and continuously improving year over year, you can significantly enhance your GRESB score. This not only demonstrates your commitment to sustainability but also aligns your portfolio with the growing expectations

Intensities

GRESB calculates the average Energy/GHG/Water Intensity by dividing the total consumption by the total asset size. This calculation is done at the property sub-type level and includes only assets with 100% data coverage (Area/Time). Assets with incomplete data coverage are excluded, emphasizing the importance of comprehensive data collection. While GRESB does not yet score intensities, that they are now calculated and will potentially be scored in the future reflects a shift from simple data coverage to the measurement of actual performance. Those managers whose strategy already includes upgrading and retrofitting assets to improve efficiency will be better prepared for such a shift. Tracking asset-level intensities outside of GRESB reporting is the first step in gaining insights to improve performance.

Strategies to Improve GRESB Scores

Enhance data collection and reporting: Invest in robust data management systems to ensure comprehensive and accurate data collection across all assets. Structuring, organizing and collecting data with the appropriate tool can streamline this process. Platform audit features can help you to identify and rectify gaps in data coverage.

Optimize energy performance to improve the LfL score: Implement energy efficiency measures across your portfolio. This includes upgrading to energy-efficient lighting, HVAC systems, and conducting regular energy audits.

Increase renewable energy use: Invest in onsite renewable energy projects and purchase offsite green power. This not only improves your GRESB score but also reduces your carbon footprint (The LfL change is worth 2 points within GRESB).

Commit to high-quality data and engage stakeholders: High-quality data is the bedrock of accurate performance assessment and improvement. Shareholders are increasingly focusing on the underlying data quality, making transparency and adherence to frameworks like the GHG Protocol critical. Ensuring that your data processing follows these standards not only improves your GRESB score but also builds trust with investors. Communicate your sustainability goals and performance to stakeholders. Transparency and engagement can drive further improvements and build investor confidence.

Conclusion

Improving your GRESB score requires a meticulous focus on asset-level performance and data quality. By ensuring comprehensive data coverage, optimizing energy performance and increasing the use of renewable energy, you can significantly enhance your ESG performance. At Scaler, we are committed to helping you achieve these goals and demonstrate your sustainability leadership to shareholders.

Let's work together to build a more sustainable future and achieve superior GRESB scores through data-driven insights and strategic asset management.