Protect Value.

Drive Performance.

Stay Ahead.

Scaler empowers real estate managers to protect investments, reduce operational costs, and meet reporting obligations. Our best-in-class tech delivers faster decisions, smarter strategies, and audit-ready documentation across your entire real estate portfolio.

Some of Our Clients:

Our Unique Approach at Scaler

3 key problems

1 holistic solution

Protect your investments, reduce operational costs, and simplify reporting.

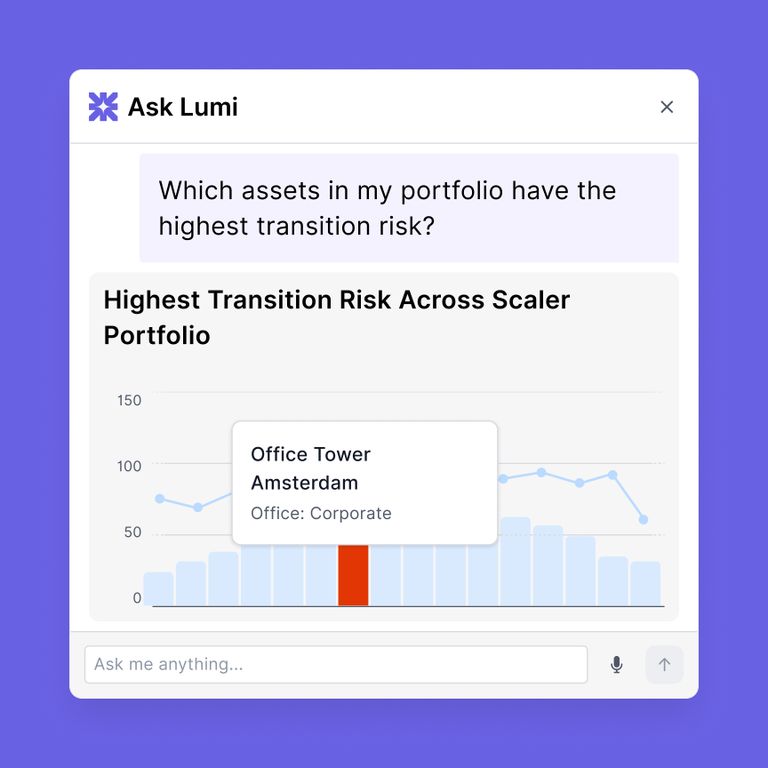

Augment Data with our AI Engine

Accelerate Data Collection

Effectively Plan & Report

From Complexity to Clarity

Scaler enables real estate teams to safeguard asset value and enhance financial performance by converting fragmented sustainability data into actionable, real-time insights. From identifying underperforming properties and developing strategic decarbonization roadmaps to streamlining reporting, Scaler delivers the critical intelligence needed for timely decisions and effective results.

100 million100 million kg of CO2 saved in 2024$ 1 billion$ 1 billion in measures planned+ 25,000+ 25,000 buildings monitored

A Platform Built for Performance Driven Real Estate Teams

Asset & Fund Managers

Boost NOI by identifying outliers, optimizing retrofits, and tracking assets against CRREM or custom pathways.

Risk & Compliance Officers

Streamline data validation and generate audit-ready reports for GRI, GRESB, SFDR, CSRD, and more.

Property & Portfolio Managers

Manage your properties more efficiently and get credit for it with centralized dashboards, real-time alerts, and actionable analytics.

Proven Results from Industry Leaders

Streamline Reports with Experts

"Scaler has been a valuable partner during a particularly busy onboarding and reporting period. The platform is clear and easy to use, which made it much simpler to organise and manage ESG data across our portfolio. The team provided excellent support throughout - responsive, knowledgeable, and always willing to assist. Their input helped us meet tight deadlines and strengthened the quality of our reporting. We would certainly recommend Scaler to others" Bozena Jankowska | Global Head of Responsible Investment