Transforming ESG Reporting for Real Estate

How the INREV ESG SDDS is Driving Change

In an industry facing mounting regulatory requirements and increasing demands for transparency, the time and resources invested in ESG data collection and reporting can be overwhelming. Yet, sustainable change doesn’t emerge from spreadsheets or disparate data points; it comes from making informed decisions that guide the real estate sector toward a more sustainable future. That’s where the INREV ESG Standard Data Delivery Sheet (ESG SDDS) comes in—offering a transformative framework that streamlines reporting and fuels meaningful action.

Introducing the INREV ESG SDDS—For Free!

At Scaler, our mission is to empower the real estate industry to work efficient, not harder. We believe data should serve as the cornerstone for positive environmental and social outcomes, rather than a burden. That’s why we’re providing investment managers with the ability to generate the INREV ESG SDDS at no cost. By simply inputting the data you already collect into the Scaler platform, you can seamlessly produce the ESG SDDS—saving precious time, ensuring accuracy, and aligning with the most up-to-date industry standards.

What is the INREV ESG SDDS?

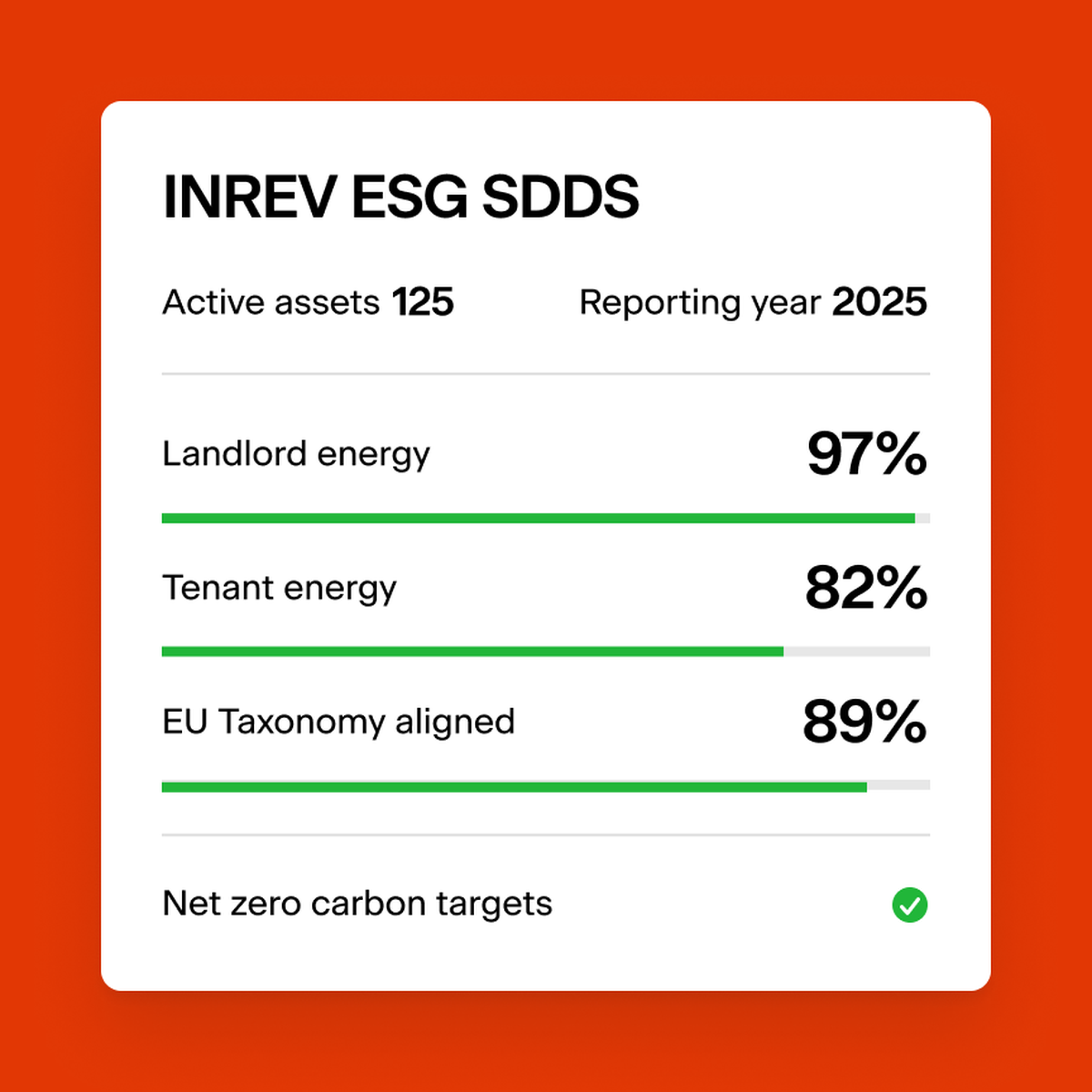

The INREV ESG SDDS is a next-generation reporting template designed to bring consistency, clarity, and comparability to ESG Key Performance Indicators (KPIs) within the real estate investment landscape. Released in November 2023, it revolutionizes ESG data exchange by introducing machine-readable labels and standardized formatting. This makes capturing, sharing, and understanding ESG metrics more efficient than ever before.

Why Should Investment Managers Use It?

As ESG reporting standards become more complex and regulatory demands like the Sustainable Finance Disclosure Regulation (SFDR) grow, it’s essential to adopt a unified, widely accepted framework. The ESG SDDS offers exactly that. It enables managers to present data in a consistent format, allowing investors to quickly compare ESG performance across portfolios. This leads to greater transparency, streamlined compliance, and improved trust in the data you provide.

Key Benefits of the INREV ESG SDDS:

Standardization Reduces Hassle: A uniform reporting structure lessens administrative burdens and cuts down on repetitive tasks. Timely Insights for Investors: Align the ESG SDDS production with your annual reporting schedule to deliver insights precisely when investors need them. Comprehensive Data, Meaningful Insights: The ESG SDDS focuses on impactful data points at both the asset and vehicle levels, enabling nuanced analysis without cumbersome data management. Regulatory Alignment: Tied to frameworks like SFDR and GRESB, the SDDS ensures your reporting meets regulatory expectations right from the start. Automation-Ready: With machine-readable labels, the SDDS streamlines data exchange and facilitates automation—unlocking more time for strategic sustainability initiatives. Focus on Action, Not Administration: By simplifying the reporting process, you can redirect attention toward achieving real sustainability goals and improving the built environment’s long-term outlook.

What Investors Are Saying:

“The ESG SDDS improves the way investors receive and evaluate information, making investment analysis effortless and efficient.” – Amilcar Grot, Achmea Investment Management

“With its asset-level data section and standardized approach, the ESG SDDS ensures comprehensive, consistent reporting.” – Derk Welling, APG Asset Management

“It reduces ambiguity in ESG standards, enabling us to allocate resources toward broader sustainability goals.” – Rudy Verstappen, Altera Vastgoed

Join Us in Driving the Future of Sustainable Real Estate As the industry shifts toward more responsible, data-driven ESG strategies, standardization and accuracy in reporting will be key. The INREV ESG SDDS represents not just a template, but a tool for transformation. By using the Scaler platform to generate these reports for free, you’re taking a critical step toward making ESG data more accessible, actionable, and aligned with the objectives of a truly sustainable real estate market.

Ready to Get Started? Contact Scaler today to learn how you can begin producing the INREV ESG SDDS and be part of the movement that’s streamlining data, accelerating action, and shaping a net-zero future.