Data as a compass for net zero

The globally supported goal of limiting the earth’s warming to 1.5 degrees becomes more critical every day. It demands action. But how do we engage in the necessary transition in a realistic and financially sustainable way?

The Carbon Risk Real Estate Monitor lays out science-backed pathways for the real estate industry to reduce carbon emissions by 2050. But they are stringent (0.4 CO2/m²/yr in 2050), with no reliance on green energy purchases or carbon offsets.

While a necessary focus, they present a significant challenge for most portfolios. Here's where data becomes the compass for real estate investment professionals:

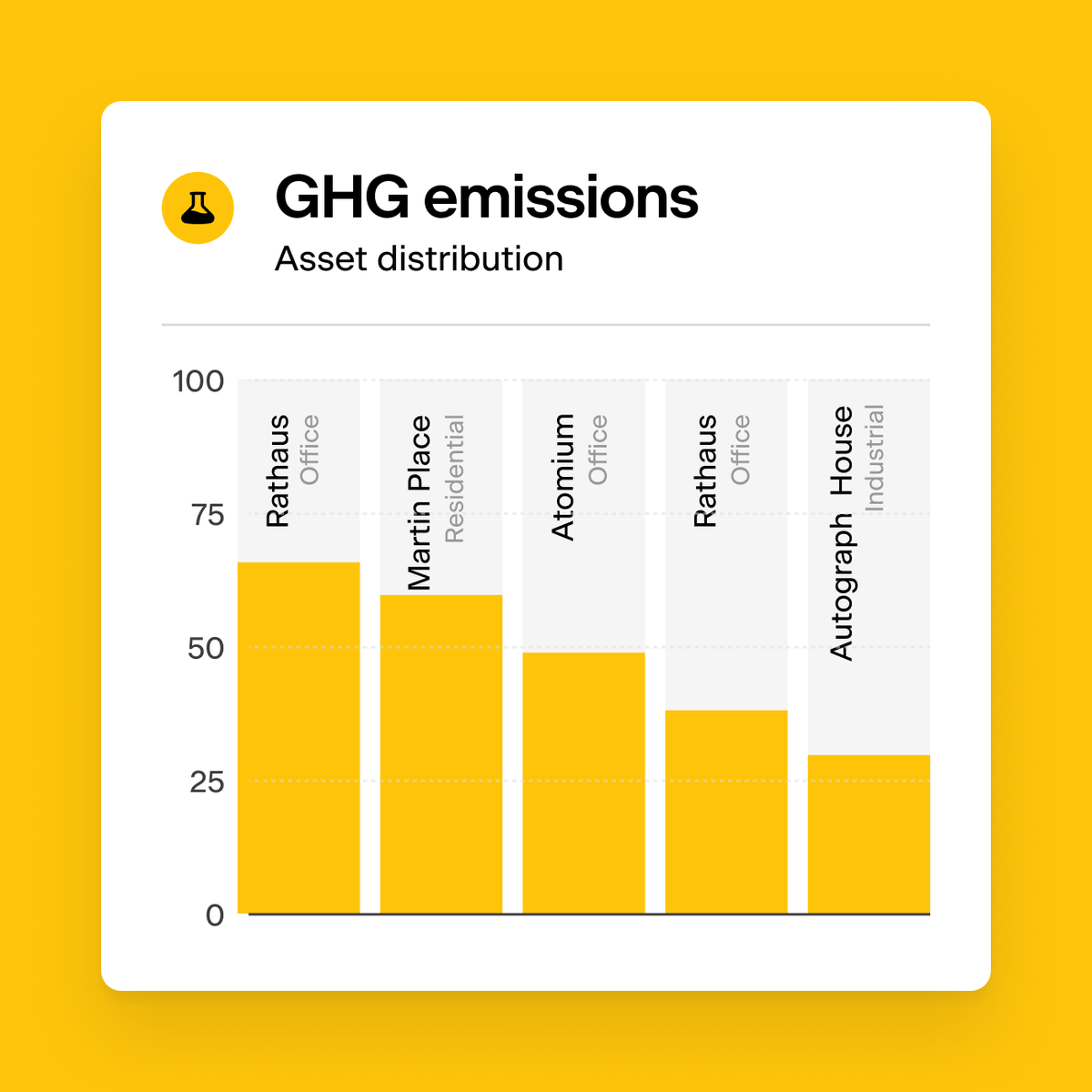

Understand your current footprint: Start by assessing the carbon footprint of your portfolio, including direct emissions from owned or controlled sources and indirect emissions from energy purchased by tenants. Then prioritise the decarbonization strategies of underperforming assets– those that diverge the most from the current year’s allotted intensity limits. These are most at risk of devaluing your portfolio.

Set realistic roadmaps: Utilize advanced analytics to understand the potential impact of various interventions. This could range from retrofitting older buildings for energy efficiency to investing in renewable energy solutions, to reevaluating occupancy patterns.

Treat cost analysis as key: It's crucial to balance ambition with feasibility. Detailed cost analyses should guide your strategy, ensuring that the path to net zero is financially viable and doesn't mislead LPs or stakeholders.

Execute on your strategy: Every year that you aren’t implementing measures toward net zero puts more pressure on your organization in terms of timelines, supply chains, resource allocation, and compliance. The industry needs to reduce carbon emissions by 55% in 2030, only 6 years from now!

Report regularly and adjust strategies accordingly: This journey requires adaptability. Regular reporting against targets, both internally and externally (like SFDR and CSRD), will ensure that you stay on track. Be willing to adjust strategies in response to new technologies, market changes, and especially where projections don’t meet reality..

Be transparent with stakeholders: Be clear with your investors and stakeholders about your strategies, progress, and the challenges faced. This builds trust and aligns everyone with your sustainability goals.

Developing and executing on a 1.5-degree net-zero roadmap is challenging. Only with a methodical, data-driven, approach can we make this goal attainable.

One of my personal goals for 2024 is to affect the shift toward realistic, actionable strategies that don't just look good on paper but deliver real change and support the organizations that are making this commitment.